I think its worth doing a more thorough job to figure out how much this company is worth. This is partly because as an equity analyst that's kind of my job (and I enjoy flexing my valuation-muscles every now and then). And it's partly because I think people will find it interesting (not least any Bloomberg employees who hold stock!).

Edit (5th Oct): Just noticed that Silicon Alley Insider have put up their list of the top-100 private tech companies, with Bloomberg crashing in at no. 2. Interestingly their $35bn valuation is bang inline with my calculation of Bloomberg's enterprise value, albeit using a much simpler approach (5x trailing revenues). Having said that, they don't take into account Bloomberg's cash pile, which I reckon boosts the value of the equity by another $11bn (and in theory would take them to #1 spot on the list!).

How to value a company

As I've written before, the only true way to value a company is to figure out what you, as an owner, are going to be getting out of it. Either in terms of cash in the bank (a classic Discounted Cashflow analysis), or in terms of getting a return on your investment (Enterprise Value-Added analysis).A word on ratios

Note, as I've said before, that valuation multiples are only a shorthand to get to valuation. Particularly comparable company analysis, where you say "I think its worth x because company y is worth z". You don't have to be a rocket science to realise there are at least three highly qualitative judgements going into that statement- "It's worth x"

- "its comparable to company y"

- and "company y is worth z".

DCF and its failings

Anyhow, both DCF and EVA are mathematically identical solutions although they differ greatly in their conceptual approaches. DCF is the most straightforward one, beloved of a class which I call "P&L jockeys". Basically it tells you how much cash profit the company is going to make which you, as an equity holder, will ultimately receive. Very simple to understand.However there are two problems with DCF. The first is that is enormously hostage to your terminal value assumption. Once you get beyond the horizon of forecasted cashflows (normally about ten years), the standard DCF values the remaining lump by capitalising it using the Gordon Growth model. Mathematically this is perfectly reasonable, but you end up with the terminal value accounting for a huge part of the value. In effect you are making one vast assumption: "I think in the year 2512 [remember we are discounting into perpetuity], this company will still be around and generating cash". Now ask yourself, how many firms founded in 1512 are still trading today?

The second problem with DCF is that as it focuses on the P&L it often ignores the balance sheet side of the business - i.e. how much you need to invest in real assets to sustain that juicy revenue growth. In theory it includes working capital and capex assumptions to capture this, but in reality they are often an afterthought. Do note however that this is less of an issue for tech companies as they tend to be less asset intensive (one of the reasons I love tech business models).

The EVA fanzone

EVA takes the opposite approach - it is all about balance sheet. It starts with the book value of your assets and how much it costs to fund them. It them figures out how much your profit is and calculates whether profit exceeds funding cost (think rental yield vs. mortgage payments). If your profits are higher than your costs, you are creating value. This approach addresses both failings of DCF - the terminal value isn't as large as in a DCF, and your are explicitly thinking about your balance sheet costs.On the downside this approach is conceptually harder to grasp than a straight "how much profit am I making" DCF approach. Also people tend to get a bit tetchy when you start talking about book value of assets. This is particularly true tech companies which (if they haven't made stupid acquisitions) tend to have low or zero assets on their book. Indeed some software companies which take a lot of maintenance payments upfront can actually have negative book value of assets! Then again if using book value as a benchmark is good enough for Warren Buffet, then its good enough for me.

How to value a Bloomberg

So which approach to take - Multiples, DCF or EVA?

As I've said I'm trying to move away from multiples and do some more fundamental valuation work. Ideally I've do a full-fat EVA analysis but unfortunately I've got one big problem - I haven't got any balance sheet data (or much financial data at all, for that matter!). I had brief hopes of excavating some historical net-asset-value data from the Merrill Lynch annual reports (ML used to have a 20% stake in Bloomberg so occasionally reported the value of this stake). However when I turned to the reports there was very little. Prior to 2007 the value of the stake is lumped together with a whole load of other stuff. The 2007 report itself records a $373m carrying value for their stake (p116) which would imply an overall book value of $1,865m for the group's equity. However this sounds suspiciously low (I figure it's about a year's worth of retained earnings), so this looks like a dead end.

So unfortunately we're back to good old DCF analysis for all its failings. Natch.

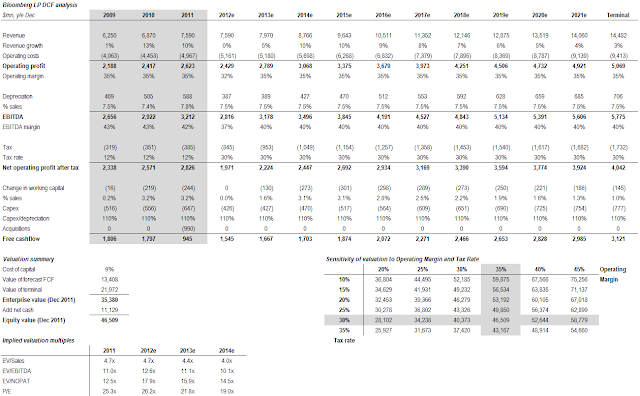

This is this what I found (click on the pic for a more zoomed-in view):

Looks nice, huh? But as I said don't be fooled by all the spurious accuracy. There is, unfortunately, a vast gap between the data I'd like to have and the data I've got.

But this is where I'm coming from:

- Revenue growth: I'm figuring zero growth this year (not a good year for anyone in the capital markets, but Bloomberg as been pretty resilient in the downturn), going back to up roughly 10% mid-term growth. For context Bloomberg has grown revenues at a 10.1% CAGR over the last five years and a 11.1% CAGR over the last ten. I have a 6.7% CAGR over the next five yeras and 6.4% over the next ten. Note this also includes growth from recent acquisitions (e.g. BNA) and expansion into new verticals (law, sport, politics etc.). If acquisitions are fully funded from the operating cash pile (and the cost is fully reflected in earnings - which it often isn't!) I see little difference between buying and building business. Ultimately its budgeting decision.

- Operating margins: I assume margins take a little hit this year before going back up to 35% mid-term, inline with Bloomberg's historical levels (or as much of them as I can make out). That's about par for a single-digit growth incumbent software/processing business - viz Oracle, Microsoft.

- Depreciation & Capex: Precious little to go on here, but I note that Thomson Reuters Markets division reported Depreciation at 7.4 - 7.8% of sales in 2010 and 2011. So I'm assuming a similar lever (7.5%) for Bloomberg. I assume capex is 110% of depreciation - i.e. Bloomberg is spending more on new assets than it is depreciating old ones. That seems sensible if you are assuming revenues continue to grow.

- Tax rate: The only reported tax rates for Bloomberg (in the mid-2000s) are very low (around 10%). This is probably due to various shenanaghans around its private company/limited partnership status. For valuation though its important to think about what tax rates will be in the future. I don't think this special private partnership structure will continue forever (and low historic tax rates may just reflect taxes deferred to future years), so I'm just whacking in a full "normal" tax rate of 30%.

- Working capital: For inventories I am assuming all users have a physical Bloomberg terminal and Bloomberg needs to replace these once every three years (plus terminals for new sales). I assume they hold two months of physical terminal inventory on hand on the balance sheet. For receivables I assume customers have 90 days to pay up (likely to be lower actually, given Bloomberg charge a monthly fee for their terminals) and so Bloomberg carries 90 days of billings on their balance sheet. I assume zero payables to suppliers (a conservative assumption as any payables would reduce the working capital burden). This gives me working capital equivalent to 34% of revenues on the balance sheet - for my forecast I assume that ratio remains constant.

- Net cash: I assume Bloomberg has net cash of $11.1bn on its balance sheet. This is basically the free cashflow from the last nine years cashflow I have reconstructed, minus $990m paid out in 2011 to acquire BNA. Obviously I add this back to my DCF-derived Enterprise Value to get to an Equity Value.

- Cost of capital: Financial academics have long and involved discussions about the appropriate cost of capital, WACCS, levered and unlevered betas and suchlike. I take the Indiana Jones approach and use 9%. In my experience that's the right cost of capital for a growing tech company (as a rule of thumb below 8% is too low and above 10.5% is getting punchy).

Capiche?

Anyhow this may all sound like financial jargon to you - but this is honest-to-God the sort of thing a Wall Street analyst uses to lay out their valuation (minus the lack of financials of course). And if you want to delve more I've whacked my full Bloomberg model (lol) up on Google Docs at the following link. Feel free to download and play:

A nice price for a Bloomberg

So here is the summary of my model, excerpted from the table above. It gives an Enterprise Value (the value of the ongoing business) of $35.4bn and an equity value (the value of the business + the cash on balance sheet) of $46bn. That's in the same ballpark as the $38-42bn number I put up before, maybe a little higher.

Looking at this with my nuanced analysts eye I would say the DCF number looks sensible, although its perhaps a touch on the high side. This is where I used valuation multiples to cross-check. I also show the EV/Sales, EV/EBITDA and P/E ratios implied by the DCF valuation. Note that we are pretty much all the way through 2012 now so the 2013 and 2014 numbers are the ones you should be focusing on.

As I said before, as a rule of thumb I figure EV/Sales runs at about 10x operating margin. So a 4x+ EV/Sales on a 35% operating margin is a little high. The P/E of 19-22x also looks rich given this isn't a massively high growth company. Note this is going to be distorted by the high cash pile (a quarter of the groups valuation) and the relatively low returned being earned on that cash (I assume 2-3% interest rates rising to 4% in the longer term). Net cash piles tend to inflate P/E ratios (this is a problem AAPL also has).

It's probably better to look at the EV/NOPAT (cash-adjusted P/E) of 15.9x - 14.5x. That's similar to the P/E ratios for other large tech companies; for comparison Oracles trades on a current-year P/E of 12,7x, SAP 18.1x and Microsoft 10.6x and IBM (the world's second-biggest software company dontcha know) of 14.4x. Of course you will find much much racier multiples for some cloud computing companies (and as I've said there's a strong argument that Bloomberg is the world's biggest cloud company), although bear in mind these companies tend to be much smaller and have a much longer "runway" of revenue growth ahead of them. Bloomberg is at a much more mature stage of growth than that.

Or to put it another way, if I was running the IPO of Bloomberg and wanting to put out the seller's view of valuation. I think this is where I'd come out at.

Oh and while I'm on the topic of the IPO, if Michael Bloomberg does have 88% of the equity then that implies 12% is in the hands of employees and other founders (hello Mr Secunda!). I make that $371,000 of equity per employee, or $248,000 if you exclude Mr Secunda. Lucky chaps!

No comments:

Post a Comment