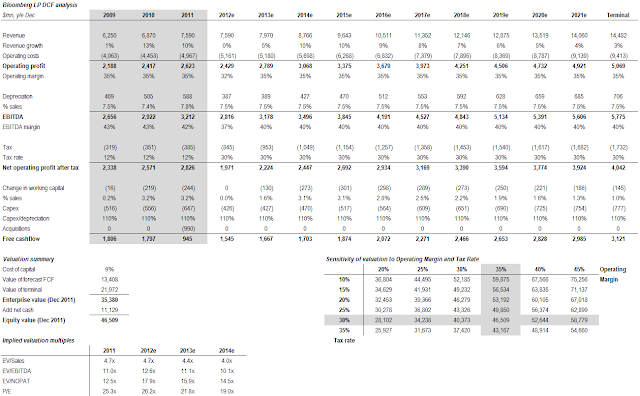

Quick Edit (3rd Oct): As a coda to this series I've put up a more detailed valuation analysis of Bloomberg (if you want the short answer, its $46bn with a wide corridor of uncertainty). For more details check it our here!

Stop. Read. This is important.

Over the past week I've been writing a series on Bloomberg, probably the largest cloud company in the world (and definitely the largest cloud company you've never heard of). If you haven't read them it's worth doing so - if you care about finance, tech and cloud computing you will almost certainly find something in there that will surprise you:

In the last post I want to outline where Bloomberg is going to go next. It's increasingly clear they want to move beyond being "just" a terminal provider. That has serious implications for the industry.

For anyone who works in an investment bank, Bloomberg might be about to become your biggest competitor.

Mr Bloomberg has a problem

Overall Bloomberg has had a good crisis. As my analysis of their financials shows, they seem to have been able to grow revenues consistently through the downturn. Even in their worst year (2009) it looks like revenues grew 1%, and terminal volumes were only down 2% (albeit helped by some M&A - stripping out the BusinessWeek acqn presumably revenues would have declined 2009). That's doubly impressive given their business model is almost entirely exposed to Wall Street headcount. By pursuing an aggressive overseas expansion strategy, it looks like they have been able to ride out the worst of the turmoil in their home markets.

Nonetheless compared to competitor Reuters, the trend is impressive. The chart to the right shows Bloomberg's group revenues ($mn) vs. Reuters' Markets Division (NB 2008 is proforma for the Thomson-Reuters merger). While the businesses are not wholly comparable (e.g. Reuters does not operate Bloomberg's physical terminal leasing model), it looks like Bloomberg has taken advantage of the crisis to leapfrog its biggest rival. As a private company Bloomberg has had the luxury of being able to invest heavily into the downturn, at a time when most of its listed competitors are having to cut back in order to hit market earnings targets.

However at the same time the crisis has presented a fundamental challenge to Bloomberg's model. I would characterise Bloomberg's historic model as "money for old rope". Although its terminals supplied a vast array of complex analytic capabilities, in my experience the majority of its users simply used it for 1) news, 2) stock quotes and 3) instant messaging. At the time this was great business for Bloomberg because customers were happy to stump up over $20,000 a year for the privilege. In effect they were buying a Cadillac and then using it to drive to the corner shop.

Of course in a downturn customers get meaner and keener. Volumes naturally fall as they shed staff (Lehman brothers alone used 3,500 Bloomberg terminals), and despite Bloomberg's moats they might - quelle horreur - even consider cut-price alternatives like S&P Capital IQ. If all they are using is news, quotes and messaging, they might be willing to take the competitive hit of moving off the Bloomberg platform in favour of saving a few pennies.

The solution for Bloomberg is obvious. They need to drive deeper into the customer, and get them using deeper functionality which a cut-price competitor like Capital IQ cannot provide. In effect they need to enter new (but adjacent) markets.

The problem is these markets are inhabited by some of Bloomberg's biggest customers.

Bloomberg's solution is to dig deeper

In fact Bloomberg has been pursuing a two-pronged approach to driving revenues. It has been trying to go both deeper and wider into its customers.

- Wider: Attack entirely new markets/verticals, in particular legal research (through its $990m acquisition of legal research house BNA) and government (through the launch of its Bloomberg Government subscription service).

- Deeper: Provide more services in its native finance vertical, such as industry research, corporate access and trading.

This post is less concerned with Bloomberg's move to go wider. That is not to say its unimportant - the BNA move was probably its biggest acquisition ever, and put it into a head-to-head fight with incumbents LexisNexis (owned by Reed Elsevier) and WestLaw (owned by Thomson Reuters). The government move is also fascinating - I am always bemused by the

vast sums of money spent on elections in the US (here in the UK we can do a perfectly free and fair general election for

thirty million quid). And despite the vast spending the whole Beltway set-up sounds like a bit of a cottage industry (or maybe that's just the West Wing version), presumably a ripe market for a big, data-heavy player like Bloomberg.

However I am more interested in Bloomberg's push to go deeper into the market, as this is where the conflicts are most fascinating (and remember, this blog is all about conflicts). In the past few years I've noticed Bloomberg launching an increasing number of initiatives aimed at increasing its footprint with its financial customers:

- Bloomberg Industries: Over the past few years Bloomberg has been building up a stealth equity research platform, Bloomberg industries. It provides industry and stock research on a wide range of sectors (more than many bulge-bracket investment banks), and has recently gone global. While they do not provide direct Buy/Sell recommendations (to avoid competing against their customers at brokers), the product looks much closer to broker research than conventional industry research (e.g. by IDC and Gartner in the tech space). As they say themselves, the staff are mainly experience buy and sell-side analysts. If you want more of a flavour of the personnel, just do a quick Linkedin search.

|

| Bloomberg Industries research - isn't this what we have Sellside Analysts for? |

- GLG tie-up: A prototype of the Bloomberg Industries rollout was its earlier tie-up with Gerson Lehman Group, the (in)famous "expert networks" provider. Again this helps provide customers the sort of industry scuttlebutt previously purveyed by research analysts at banks. In fact given the negative publicity over expert networks coming from the Galleon trial I suspect that Bloomberg have more of this field to themselves, with investment banks rethinking their involvement.

- Corporate access: Corporate access (bringing company management's round on roadshows to current and potential investment) is another staple of the large investment banks, who traditionally act as intermediaries between companies (who are their clients on the investment banking side) and investors (who are their clients on the broking side). Bloomberg are now muscling in on this area. I was particularly interested to see a firm run by an old colleague from Morgan Stanley signing a European alliance with Bloomberg for corporate access.

- Bloomberg Vault: Given the volume of communications which run through its Instant Messaging platform, an archiving and compliance solution was something of a no-brainer. Lo and behold Bloomberg has launched Bloomberg Vault. Having previously covered Autonomy (which had a thriving archiving business with investment banks) prior to its acquisition by HP, I can say this is definitely a great cloud business. It also has the handy advantage of being counter-cyclical - when things get worse the lawsuits mount up and banks suddenly need to cover their ass on the compliance front!

- Bloomberg Tradebook: And of course we shouldn't forget Bloomberg's existing broker-dealer business Tradebook. While this isn't anything new (it apparently had $420m of revenues back in 2007). Given Bloomberg's ability to invest in the business through a downturn without having to worry about public earnings expectations, I'm not surprised to see them making an international push with this business at the moment.

|

| Bloomberg's trading floor - sure looks like a bank to me. Hey they even have Bloombergs! |

- Consensus data and financial models: In the last few years as a Bloomberg user I've noticed a marked step-up in the quality of company-specific data which Bloomberg provides. In particularly they moved away from IBES in favour of providing their own consensus estimates. Also the quality of the financial models is much better - they will now give you a spreadsheet where you simply input the ticket of your company and it will download and fully populate a model with full quarterly and annual financial statements. That's invaluable for investment research if you want to do quick-and-dirty analysis on a company you're unfamiliar with - and also short-cuts the normal buyside procedure of pining a friendly broker for their model.

The problem is these moves pit Bloomberg in direct competition against some of its biggest customers.

Bloomberg eat their customers

What's clear about these initiatives is they (with the exception of Bloomberg Vault), they bring Bloomberg into more and more competition with brokers and investment banks.

Note Bloomberg has two breeds of customers. Those on the "Buy-Side" (primarily fund managers) gather assets and invest them. Bloomberg does none of that and doesn't want to. However those on the "Sell-Side" (investment banks and other brokers) exist to provider services to fund managers to facilitate their investment.

Well that's also Bloomberg's job description.

I would imagine Bloomberg's response to this is twofold (and yes I am putting words into their mouth here):

- We are not directly competing with brokers - note that their Bloomberg Industries analyst do not give buy/sell recommendations like Wall St analysts do. However in reality much of the value of sellside brokers is not tied to their recommendations. Sure some analysts earn a reputation as stock-pickers, but I've seen other number 1 ranked analysts which have been appalling at calling their stocks, but very good at in-depth industry insight. That is precisely what Bloomberg Industries claims to offer (albeit with a slightly more data-driven bias). Plus there's the simple fact that many functions such as Bloomberg Tradebook, roadshows and generating models do compete with what investment banks offer, fair and square.

- Even if they we are coming after you, actually what we are doing is the mundane maintenance stuff (consensus estimates, maintenance research, roadshows). We are actually freeing your hot-shot analysts from tedious jobs so they can write proper differentiated research. Unfortunately the reality is that for investment banks it is the mundane maintenance stuff which pays the bills. When I was an analyst I could never quite understand why buy-side firms gave so much of their vote to roadshows - it wasn't particularly hard for the analyst to arrange (it was basically a glorified exercise in logistics) and presumably if you were a big enough fund you could ring up the company and set up the meeting yourself. Maybe it was the convenience factor, but anyhow this is clearly a very high margin line of business for a broker. Similarly with maintenance research - every quarter we would do a bog-standard sector earnings preview which seemed to the epitome of commodity research. But when we were a few days late getting it out clients would ring up asking where was the preview. In effect this is "money for old rope" business.

And Bloomberg want a piece of it.

Taking a step back, the great value of the modern investment bank is twofold. First they provide capital (and therefore liquidity). Secondly they provide a network. They know the corporates, they know the investors they should roadshow to. They know who is selling a stock and they know who would like to buy it.

Now it might just be the times we are living in, but there is a shortage of capital out there. This erodes banks previous advantage - they can no longer leverage themselves to buggery in order to facilitate client business (and/or take bets on the side). But the second advantage - the network - is something that Bloomberg can provide. Through their messaging platform they now reach everyone who matters. If a corporate wants to arrange a roadshow Bloomberg can scour their database of holdings and figure out who owns a company's stock. Add in a dose of predictive analytics and they could probably figure out who would like to

buy that company's stock.

As I said, Bloomberg eats its customers.

Maybe the customer's baseball bat isn't as big as it looks

|

| Take one step closer and I'll use it I swear! |

Of course the customers still have a great big baseball bat they can hold over Bloomberg. The banks are all big customers of Bloomberg, so in theory if Bloomberg started stepping on their toes too dramatically they could take their business elsewhere. That should - in theory - hold Bloomberg in check.

But then again maybe its not that bad.

Its worth thinking about Bloomberg's exposure to the big banks (who I think are the firms most likely to push bank; smaller firms would probably be quite pleased to see Bloomberg taking chunks out of their bulge-bracket competitors). According to the

NY Times, Lehman had c3,500 Bloomberg terminals before the crisis and they were a mid-sized global investment bank. I would imagine other banks would have been larger, but then they would have slimmed down since then. Maybe an average of 3,500 terminals today is a decent proxy. If so then that would imply the nine global banks (Goldman, Morgan Stanley, JPM, Citi, Merrill, UBS, CS, Deutsche, BarCap) have roughly 32,000 terminal between then or just over 10% of Bloomberg's total.

Thinking about it that way, the VAR (Value at Risk) doesn't actually look that bad. After all they couldn't completely cut their spending (Bloomberg is too deeply embedded in their customers to that - remember what I said about their moats). And for Bloomberg while revenues from new offerings might not immediately make up for any shortfall, in the long term it gets them into new markets, and makes their revenues stickier so (i.e. - it improves earnings quality).

In short this epitomises the Innovator's Dilemma. Bloomberg has offerings which potentially cannibalise its existing business. But there is enormous upside if they could disrupt the market and succeed.

Bloomberg could go even deeper

Actually I think Bloomberg's existing offerings only scratch the surface. I think there's a whole bunch of other areas (both for buy-side and sell-side) they could enter or expand their existing offering.

- CRM: At every bulge bracket I've worked with there's been a clunky, homebrew CRM system where you can click to register you client calls, send voice-mails or blast emails. I've always wondered why everyone doesn't just suck it and move to Salesforce.com. Anyhow if they do outsource then Bloomberg would be the perfect trusted partner to provide this. Heck the majority of client communications probably go through their messaging already.

- Content management: Actually Bloomberg are doing this already (most investors pull pdf notes from Bloomberg rather than from broker websites). But there is definitely room for Bloomberg to bulk up the content management side, add analytics and maybe even get embedded in the publishing workflow.

- Portfolio management and prime brokerage: Offering buyside clients portfolio analysis and risk-managements tools on a SaaS basis is something they do already but could always do more. In particular I was piqued by a story I read this week about Scotiabank expanding into prime brokerage using a third-party IT solution. Prime brokerage (basically outsourced trading, lending, custody for hedge funds) strikes me as precisely the sort of high-margin business Bloomberg would want to get into. With their huge cash resources Bloomberg certainly have the balance sheet to facilitate this, and it sits nicely with their existing broker-dealer business.

- Equity distribution: This is the blue-sky one. Its frequently been noted that underwriting and distributing IPOs is incredibly profitable business for banks. So long as you get the pricing right, there is very little risk (if the stock won't sell you just pull the offering), and historically only the big banks have had the buyside contacts book to find the buyers. Of course there are certain regulatory hurdles here, but its not as off the wall as you think. In my time I've seen a number of forays by bond or money-market dealers into equities (e.g. ICAP, Cantor Fitzgerald). Normally they peter out because the challenger lacks the resources and resolve to stick with it - not a problem for Bloomberg.

Why this matters for investors

Of course as a common-stock equity investor why should you care? After all Bloomberg is private and has always been private. It doesn't affect you right?

I think the reasons should be obvious.

- If you are investing in Thomson Reuters, Reed Elsevier or any company which Bloomberg competes in, you should want to know what their biggest competitor is up to.

- If you are working at an investment bank or at a fund manager you will want to know what Bloomberg is up to, because one day they may be either your biggest supplier or your biggest competitor.

- If you like buying hot tech IPOs you should be doing your research now, because at some point Bloomberg is going to go public. In particular bear in mind that Michael Bloomberg steps down as NYC mayor at the start of 2014. Assuming he's not going to run for the Presidency (he'll be 74 in 2016 - Reagan was only 69 when he was elected) he seems likely to leave public life. This means his Bloomberg stake becomes unlocked and all bets are off. A mid-2014 IPO would be the obvious option.

In short, you should never underestimate Michael Bloomberg.

Edit: One related thought which occurred on the way to the shops this morning. Bloomberg and Linkedin are a match made in heaven. If Bloomberg's pitch is that it can provider a better network than the banks have, then Linkedin gives them the best network in existence. If their strategy is to broaden into other industries, Linkedin gives them that network in any vertical they can name.

Of course its not going to happen at the moment because a) Bloomberg will believe they already have a damn good net work in the financial world (they do) so why pay a take-out premium to replicate it and b) LNKD has a $13bn market cap so would probably cost >$16bn to take out - much more than Bloomberg's cash reserves. But if the stock ever got bombed out (hey, the P/E's only 1050x at present) it would be a mouth-watering deal.